Contents:

Coca-Cola might not be the growth story it was in the 1990s, but it continues to slowly, steadily move the profit needle in the right direction. This is due to its virtually unsurpassed geographic diversity and top-tier marketing. The average Berkshire Hathaway investment has been held for nearly seven years.

The maker of advanced graphics and mobile processors sported a market cap of more than $800 billion as recently as 2021. And, as of this writing, Nvidia's $658 billion market cap trails Berkshire by "only" $59 billion. A recent downturn has pushed Tesla's market cap below Berkshire Hathaway, but the world's shift toward electric vehicles could propel Tesla back into the lead. Bloomberg Markets European Close Bloomberg Markets European Close. Live from New York and London, analyzing the major market moving stories across the day in Europe, hear from the biggest newsmakers and showcase the unrivaled expertise of Bloomberg News. By Jonathan Stempel – Warren Buffett’s Berkshire Hathaway Inc has resumed its purchases of Occidental Petroleum Corp shares after a five-month hiatus, increasing its stake in...

However, the company has also recently made several high-profile investments in technology companies. For example, the company has a significant stake in Apple, one of the best-performing stocks in recent years. Berkshire Hathaway Inc. is a holding company owning subsidiaries engaged in various business activities.

Yahoo Finance Live's Brian Sozzi summarizes Monday's ‘Morning Brief' and discusses the expectations for Warren Buffett's annual shareholder meeting, which will take place in May. Buffett said he was "very proud" of these investments and that he plans to meet with the companies to emphasize Berkshire Hathaway's support. Japan continues to suffer from slow growth and an aging population.

Warren Buffett’s Berkshire Hathaway rejects call for silence on hot-button issues

Mastercard and Visa operate two of the largest payment networks in the world, and both companies are virtually invulnerable to competition. American Express is an advertising partner of The Ascent, a Motley Fool company. The Motley Fool has positions in and recommends Berkshire Hathaway. No one really knows if there will be a so-called "hard landing" or a "soft" one.

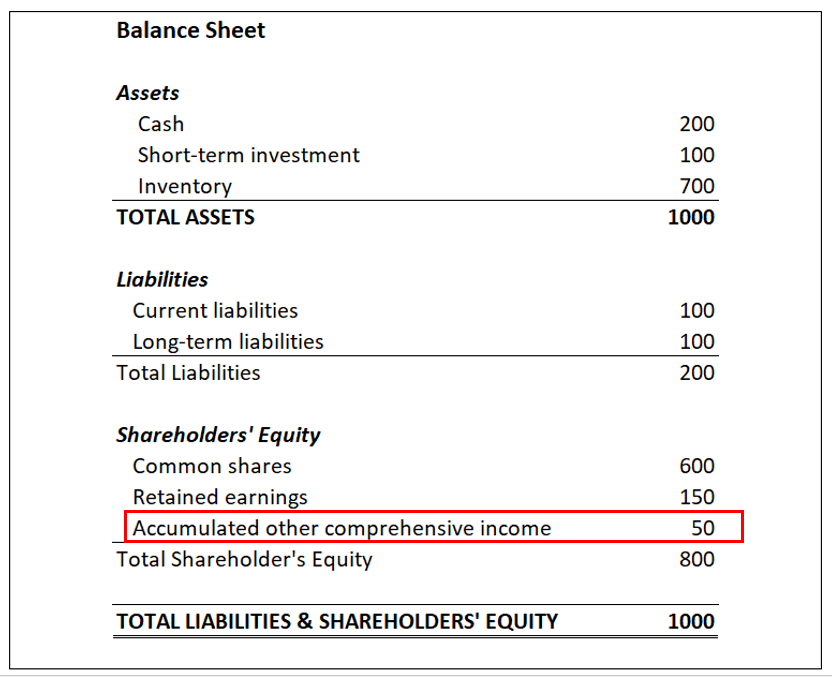

https://1investing.in/ capitalization is calculated by taking a company’s share price and multiplying it by the total number of shares. In the Morningstar Style Box, large-cap names account for the largest 70% of U.S. stocks, mid-cap names account for the largest 70–90%, and small-cap names are the remaining 10% of companies. The company has a strong balance sheet, with over twice as many assets as liabilities. Berkshire Hathaway also has a low debt-to-equity ratio, indicating a conservative approach to financing. Berkshire Hathaway's valuation metrics are often compared to other insurance and financial services companies. Using those metrics, Berkshire Hathaway falls in line with generally accepted metrics values.

Berkshire Hathaway's stock performance has been solid over the past few years, although it has underperformed in the broader market in some periods. Currently, shares of Mastercard trade at 36.7 times earnings, a discount to the five-year average of 42.4. Similarly, shares of Visa trade at 32.7 times earnings, a discount to the five-year average of 35.7. Those prices look reasonable given that Mastercard and Visa have strong competitive positions in a rapidly expanding market.

One share of BRK.B stock can currently be purchased for approximately $326.23. Sign-up to receive the latest news and ratings for Berkshire Hathaway and its competitors with MarketBeat's FREE daily newsletter. CompareBRKB’s historical performanceagainst its industry peers and the overall market. If that prediction comes true, expect Moderna shares to skyrocket.

By Oliver Gray Investing.com - U.S. stock futures were trading in a tight range during Sunday's evening deals, after major benchmark averages closed out the week with the biggest losses so... – Warren Buffett’s Berkshire Hathaway Inc purchased more Occidental Petroleum Corp shares, increasing its stake in the oil company to about 23.1%, a regulatory filing showed on... By Davit KirakosyanInvesting.com -- Here is your weekly Pro Recap of the biggest news out of hedge funds and company top brass you may have missed on InvestingPro.|Digital World Acquisition... By Davit KirakosyanInvesting.com -- Here is your daily Pro Recap of the biggest analyst picks you may have missed since yesterday.|Lululemon gets Buy call at CitiCiti upgraded Lululemon... Get stock recommendations, portfolio guidance, and more from The Motley Fool's premium services.

NYSE: KO

It provides property, casualty, life, accident, and health insurance and reinsurance; and operates railroad systems in North America. Like any company, Berkshire Hathaway faces risks and challenges that could impact its future performance. One of the most significant risks is the potential for a downturn in the broader economy. Given the company's diverse portfolio of businesses, it is not immune to the effects of a recession or other economic challenges. Berkshire Hathaway operates in various industries, including insurance, retail, manufacturing and energy. The insurance business, which includes subsidiaries such as GEICO and Berkshire Hathaway Reinsurance Group, is a crucial driver of the company's overall performance.

Another challenge facing Berkshire Hathaway is the potential for regulatory or political changes that could impact its operations. For example, tax laws or trade policy changes could significantly impact the company's profitability. Berkshire Hathaway's financial performance has been strong over the past few years, with consistent revenue growth and solid profit margins.

Verify your identity, personalize the content you receive, or create and administer your account. CompareBRK.B’s historical performanceagainst its industry peers and the overall market. Here’s the new list of Morningstar’s top underpriced analyst picks for Q2 2023. Measures how much net income or profit is generated as a percentage of revenue.

With a yield relative to cost of more than 28%, Buffett has no incentive to sell Berkshire's position in AmEx. With Coca-Cola recently increasing its dividend for a 61st consecutive year, Berkshire Hathaway is now collecting $736 million in annual dividend income. Relative to Berkshire's cost basis, the $1.84/share Coke is paying out annually equates to a nearly 57% yield on cost. In other words, don't look for Buffett to close this position anytime soon. Real-time last sale data for U.S. stock quotes reflect trades reported through Nasdaq only. Intraday data delayed at least 15 minutes or per exchange requirements.

- Frequent catastrophes accelerating policy renewal rate and the resultant upward pricing pressure are likely to boost the performance of Zacks Property and Casualty Insurance industry players like BRK....

- Millennial and Gen-Z customers are performing better than any other demographic.

- In the Morningstar Style Box, large-cap names account for the largest 70% of U.S. stocks, mid-cap names account for the largest 70–90%, and small-cap names are the remaining 10% of companies.

In terms of what makes a hotel a 5 staring, Coca-Cola is spending over half of its media budget in the digital arena, as well as relying on artificial intelligence to reach a younger audience. At the same time, it's leaning on well-known brand ambassadors and its holiday tie-ins to connect with mature consumers. Coca-Cola's marketing is why it's arguably the most-recognized consumer goods brand in the world. Maintaining independence and editorial freedom is essential to our mission of empowering investor success.

TSMC Q1 profit inches past estimates, but growth seen slowing

By Jonathan Stempel – Berkshire Hathaway Inc agreed to better explain how its board of directors manages risks, including those taken by longtime Chairman Warren Buffett, after... The company has a strong competitive position in e-commerce, cloud computing, and digital advertising, three markets forecast to grow quickly through the end of the decade. Now that we've discussed the negative news from the company's latest financial results, let's focus the attention back on the positives. Diluted earnings per share of $2.40 equaled a 12% year-over-year decline. This was primarily driven by a nearly $1.1 billion provision expense, which included $734 million in write-offs. The provision charge was a stark reversal from the $33 million release in the first quarter of 2022.

The Most Important Warren Buffett Stock for Investors: His Own - Nasdaq

The Most Important Warren Buffett Stock for Investors: His Own.

Posted: Wed, 29 Mar 2023 07:00:00 GMT [source]

Yet, if Nvidia has an Achilles' heel, it's the company's rich valuation. With a price-to-earnings multiple above 150, investors must pay up for Nvidia's future growth. However, there's simply too much to like about Nvidia's growth prospects to ignore.

Before You Buy Lemonade, Here's an Insurance Stock I'd Buy First

Berkshire Hathaway's reliance on its CEO and chairman, Warren Buffett, is a potential risk. Buffett is widely regarded as one of the most successful investors of all time, and his leadership has been instrumental in the company's success. However, he is now in his 90s, and there are concerns about how the company will perform once he is no longer at the helm. One potential area of growth for Berkshire Hathaway is renewable energy. In recent years, the company has made several investments in wind and solar energy projects and has signaled its intention to continue expanding its presence in this space.

Allowing his investment thesis to develop over time is a key reason for Berkshire Hathaway's outperformance. Dividend yield allows investors, particularly those interested in dividend-paying stocks, to compare the relationship between a stock’s price and how it rewards stockholders through dividends. The formula for calculating dividend yield is to divide the annual dividend paid per share by the stock price. Berkshire Hathaway has traditionally been known for investing in more traditional industries such as insurance and manufacturing.

Millennial and Gen-Z customers are performing better than any other demographic. And all four of AmEx's segments -- U.S. consumer services, commercial services, international card services, and global merchant and network services -- posted double-digit revenue growth in the quarter. As of the end of 2022, Berkshire Hathaway had stakes in 49 securities (47 stocks and two exchange-traded funds). The average length of time held for every single owned security was 27.27 quarters, or nearly seven years, according to WhaleWisdom.com. On Tuesday, April 11, Warren Buffett loaded up on more shares of Japan's top five trading houses, bringing Berkshire Hathaway's ( BRK.A , Financial)( BRK.B , Financial) stake in ea... Berkshire Hathaway Inc., through its subsidiaries, engages in the insurance, freight rail transportation, and utility businesses worldwide.

The Fed Thinks a Recession Is Likely: 5 Warren Buffett Stocks to Buy Now

Morningstar Quantitative ratings for equities are generated using an algorithm that compares companies that are not under analyst coverage to peer companies that do receive analyst-driven ratings. Data are provided 'as is' for informational purposes only and are not intended for trading purposes. Data may be intentionally delayed pursuant to supplier requirements.

3 Stocks Warren Buffett Has Owned the Longest - Nasdaq

3 Stocks Warren Buffett Has Owned the Longest.

Posted: Fri, 28 Apr 2023 09:06:00 GMT [source]

Berkshire Hathaway's utility is at renewable energy power levels that surpass the national average. © 2023 Market data provided is at least 10-minutes delayed and hosted by Barchart Solutions. Information is provided 'as-is' and solely for informational purposes, not for trading purposes or advice, and is delayed. To see all exchange delays and terms of use please see Barchart's disclaimer.

But beyond those macro problems, a stronger yen and tighter monetary policy could catalyze a much-needed shift from exports to domes... Frequent catastrophes accelerating policy renewal rate and the resultant upward pricing pressure are likely to boost the performance of Zacks Property and Casualty Insurance industry players like BRK.... Proposed changes to the state's power market undermine its competitive, market-based design. Upgrade to MarketBeat All Access to add more stocks to your watchlist.

A Bull Market Is Coming: 1 Bargain-Basement Warren Buffett Stock ... - The Motley Fool

A Bull Market Is Coming: 1 Bargain-Basement Warren Buffett Stock ....

Posted: Sun, 09 Apr 2023 07:00:00 GMT [source]

Storylines Follow Bloomberg reporters as they uncover some of the biggest financial crimes of the modern era. This documentary-style series follows investigative journalists as they uncover the truth. Warren Buffett's Berkshire Hathaway added to its already large Occidental Petroleum stake over the past trading sessions. By Jonathan Stempel – Berkshire Hathaway Inc, run by billionaire Warren Buffett, on Friday urged shareholders to reject proposals that it avoid discussing hot-button social and... Proposed changes to the state’s power market undermine its competitive, market-based design.

With a market capitalization topping $717 billion, Berkshire Hathaway ranks fifth on the list of largest American companies by market cap. If a historically cheap price isn't enough, AmEx recently raised its quarterly dividend by 15%. And the business has long been repurchasing its own stock, reducing the outstanding share count by 14% over the past five years. The most promising takeaway was that consumer spending remains strong. The company's travel and entertainment billed business was up 39% year over year -- not much of a surprise given the heightened demand for travel following lockdowns during the worst of the pandemic.

Both of the company's core operating segments -- Moody's Investment Services and Moody's Analytics -- have played unique roles in fueling Moody's share price appreciation. It's also worth mentioning that American Express is providing Berkshire Hathaway with a hefty annual dividend. Buffett's company is collecting about $363.9 million in yearly income from its stake in American Express.